Does homeowners insurance cover tenants sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with formal and friendly language style and brimming with originality from the outset.

Homeowners insurance provides essential coverage for property owners, but what about tenants? Let’s delve into the intricacies of tenant coverage and explore the nuances of liability protection under a landlord’s policy.

Definition of Homeowners Insurance

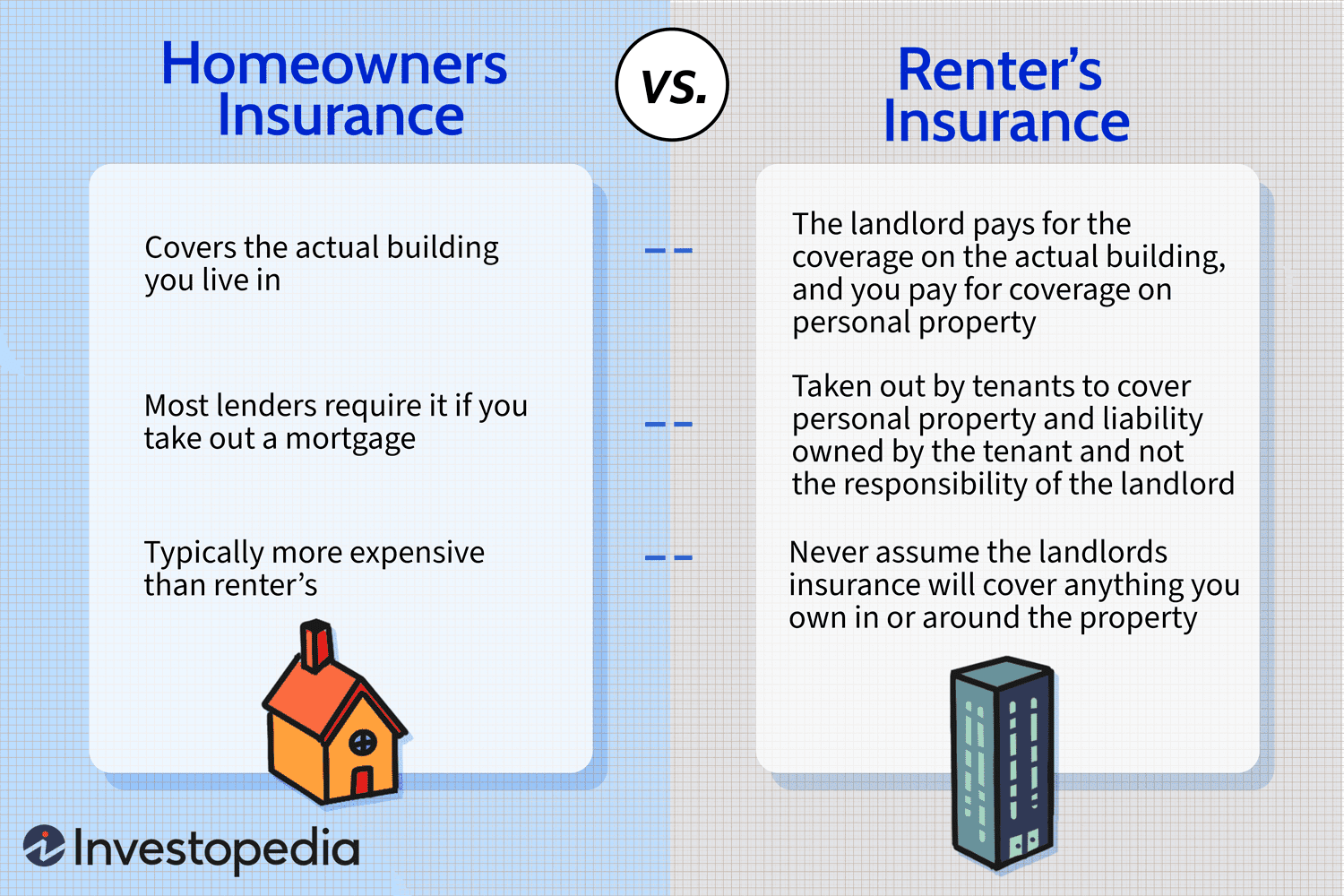

Homeowners insurance is a type of property insurance that provides financial protection to homeowners in the event of damage to their property or belongings. It typically covers damage caused by perils such as fire, theft, vandalism, and natural disasters. The primary purpose of homeowners insurance is to safeguard homeowners against financial losses resulting from unforeseen events.

Tenant Coverage in Homeowners Insurance

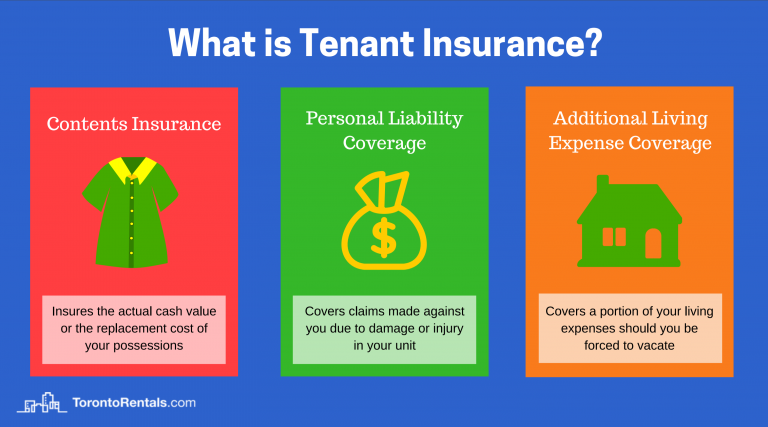

While homeowners insurance primarily covers the property owner, it may also offer limited coverage to tenants in certain situations. For example, if a tenant’s personal belongings are damaged due to a covered peril, the landlord’s homeowners insurance may provide reimbursement for the loss. However, tenants are generally encouraged to obtain their renters insurance to ensure adequate coverage for their belongings and liability protection.

Additional Rental Property Insurance, Does homeowners insurance cover tenants

Landlords are advised to have specific rental property insurance to protect their investment adequately. Rental property insurance differs from homeowners insurance in that it typically covers the structure of the rental property, loss of rental income, and liability protection for the landlord. Landlords can tailor their insurance coverage to meet the unique needs of their rental properties and protect themselves from potential financial risks.

Liability Coverage for Tenants

Liability coverage under a landlord’s homeowners insurance extends to tenants residing on the property. This coverage protects tenants from liability claims if someone is injured on the rental property due to negligence or unsafe conditions. For example, if a visitor slips and falls on the property, the liability coverage may help cover medical expenses and legal fees. It is essential for tenants to understand the extent of liability protection offered by their landlord’s insurance policy to ensure they are adequately covered in case of unforeseen accidents.

Last Point

As we conclude our discussion on tenant coverage under homeowners insurance, it becomes evident that understanding the extent of protection is crucial for both landlords and tenants. Whether it’s liability coverage or additional rental property insurance, being informed is the key to safeguarding your interests.

Key Questions Answered: Does Homeowners Insurance Cover Tenants

Does homeowners insurance cover damage caused by tenants?

Typically, homeowners insurance does not cover damage caused by tenants. Landlords may need additional coverage for such situations.

Is renters insurance sufficient for tenants living in a rented property?

Yes, tenants should consider purchasing renters insurance to protect their personal belongings and liability, as homeowners insurance typically covers the structure of the property.

Can a landlord be held liable for a tenant’s actions under their homeowners insurance?

Landlords may have liability coverage for certain situations, but tenants are generally responsible for their actions under their own renters insurance.