Major insurance companies in Texas dominate the market, offering a wide range of insurance products and innovative services. Let’s delve into the realm of insurance giants in the Lone Star State.

In Texas, major insurance companies play a crucial role in providing various insurance options to residents and businesses alike. From traditional coverage to cutting-edge services, these companies are at the forefront of the industry.

Overview of Major Insurance Companies in Texas

Texas is home to several major insurance companies that play a significant role in the state’s insurance market. These companies offer a wide range of insurance products to cater to the diverse needs of individuals and businesses in Texas.

List of Top Insurance Companies Operating in Texas

– State Farm

– Allstate

– Progressive

– Farmers Insurance

– USAA

– Geico

Types of Insurance Offered

These major insurance companies in Texas offer various types of insurance, including:

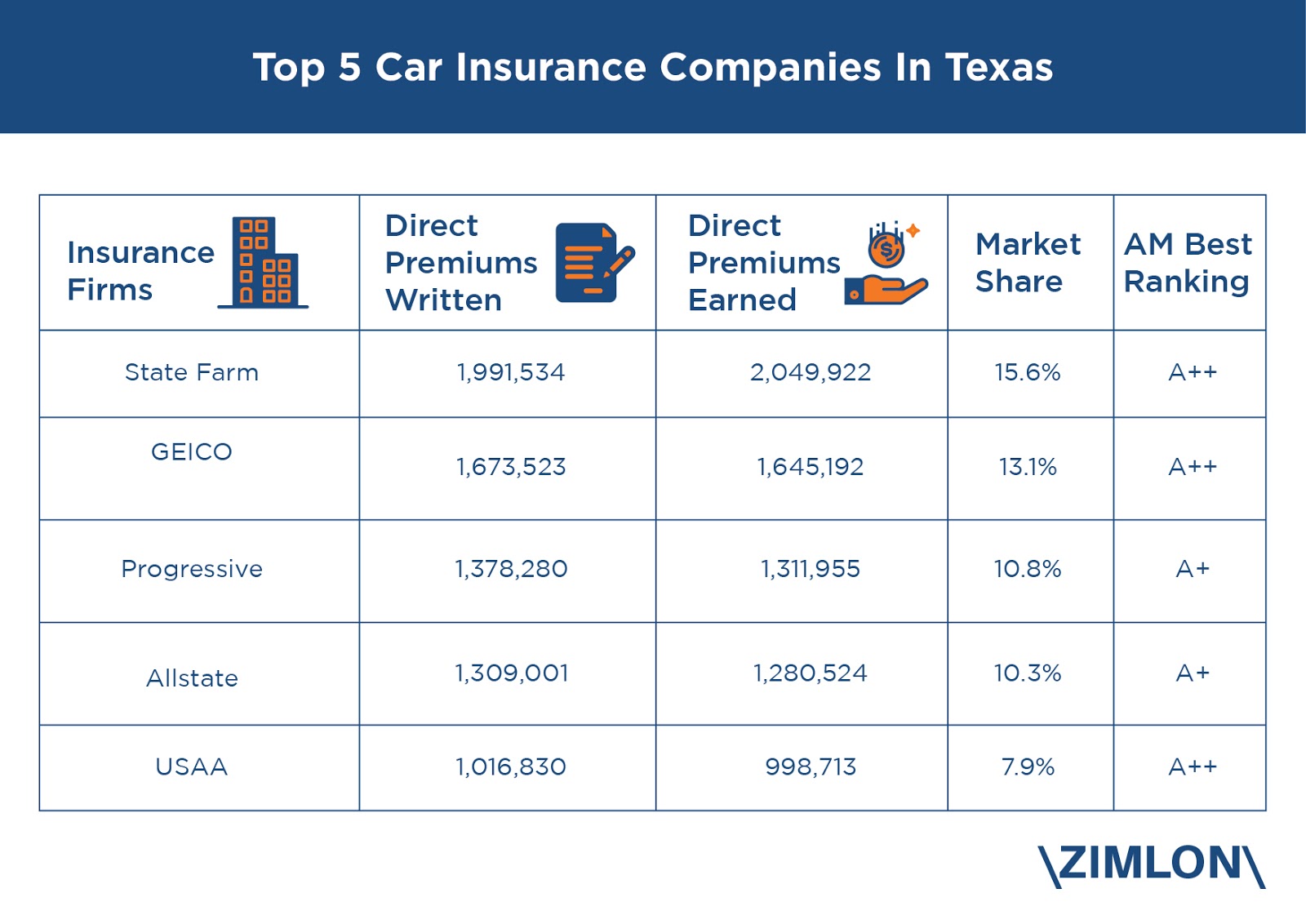

– Auto insurance

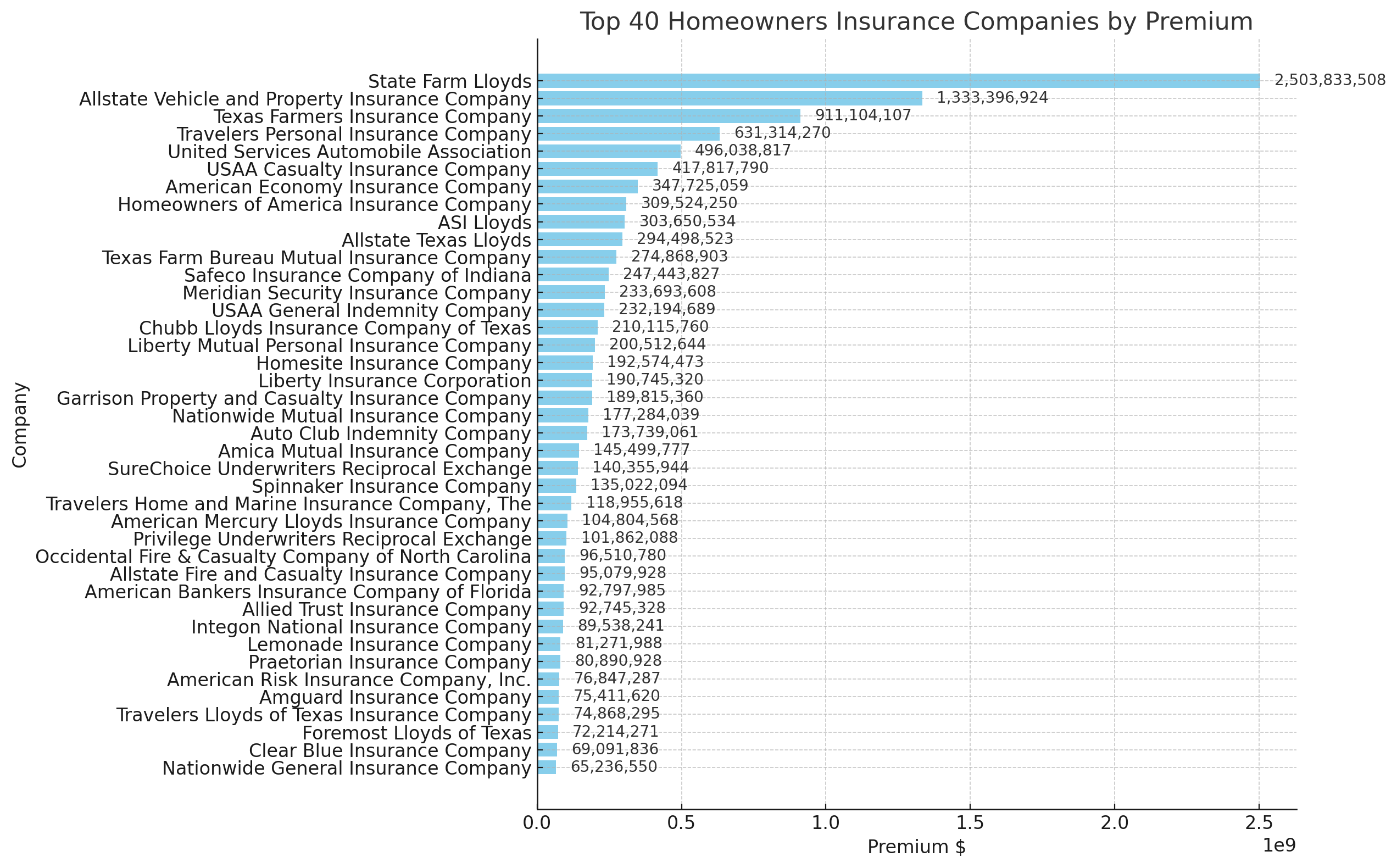

– Home insurance

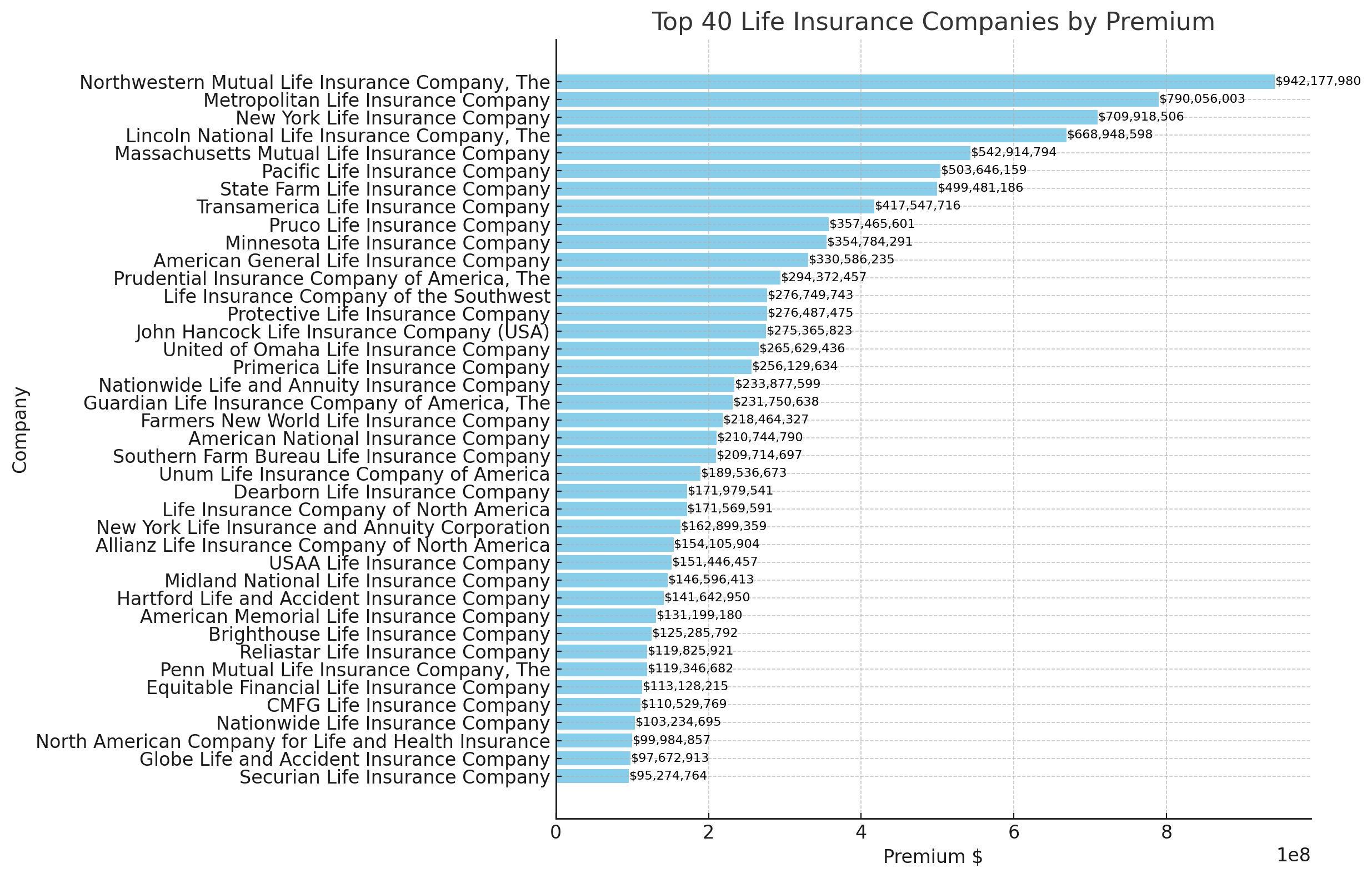

– Life insurance

– Health insurance

– Business insurance

Market Share and Presence

Each of these insurance companies has a significant market share in Texas and a strong presence across the state. They have offices, agents, and online platforms to serve customers efficiently.

Services Offered by Major Insurance Companies

When it comes to insurance products, major insurance companies in Texas provide a comprehensive range of services to meet the needs of their customers.

Range of Insurance Products

The insurance products offered by these companies include:

– Auto insurance with customizable coverage options

– Home insurance for protection against property damage and theft

– Life insurance for financial security and peace of mind

– Health insurance for medical expenses coverage

– Business insurance for commercial properties and liabilities

Unique or Specialized Offerings

Some companies offer unique or specialized insurance products such as:

– Pet insurance

– Travel insurance

– Flood insurance

– Cyber insurance

– Rideshare insurance

Coverage Options Comparison

Customers can compare coverage options across different companies to find the best insurance plan that suits their needs and budget.

Customer Satisfaction and Reviews: Major Insurance Companies In Texas

Customer satisfaction plays a crucial role in the insurance industry. Let’s take a look at how these major insurance companies in Texas fare in terms of customer reviews and ratings.

Customer Reviews and Satisfaction Ratings

– State Farm: Known for excellent customer service and claims handling

– Allstate: Offers various discounts and customizable coverage options

– Progressive: Easy online tools and competitive rates

– Farmers Insurance: Personalized service and local agents

– USAA: Top-rated customer service and military discounts

– Geico: Convenient app and 24/7 customer support

Common Feedback or Complaints

Customers often provide feedback on claim processing times, premium rates, and customer service quality. Complaints may include delays in claim settlements or billing issues.

Awards and Recognition

These insurance companies have received notable awards and recognition for their exceptional customer service and innovative insurance products.

Technology and Innovation

In today’s digital age, insurance companies leverage technology to enhance their services and streamline processes for customers.

Use of Technology

– Online policy management portals for easy access

– Mobile apps for claims filing and tracking

– Telematics for usage-based auto insurance

– AI chatbots for customer support

– Cloud-based platforms for data security and efficiency

Innovative Tools and Platforms, Major insurance companies in texas

These companies have implemented innovative tools and platforms to provide a seamless customer experience, such as:

– Virtual claims inspection

– Predictive analytics for risk assessment

– Blockchain technology for secure transactions

– Online quote comparison tools

– Smart home devices integration for home insurance discounts

Conclusive Thoughts

In conclusion, major insurance companies in Texas continue to evolve and adapt to meet the changing needs of customers. Whether it’s through technology, customer service, or product offerings, these companies remain key players in the insurance landscape of the state.

Question Bank

What types of insurance do major companies in Texas offer?

Major insurance companies in Texas offer a wide range of insurance products, including auto, home, life, health, and business insurance.

How do major insurance companies in Texas use technology to improve services?

These companies leverage technology for claims processing, customer service interactions, online policy management, and even implementing innovative tools like telematics for auto insurance.

Are there any notable awards received by major insurance companies in Texas for customer service?

Some major insurance companies in Texas have received recognition for outstanding customer service, with awards highlighting their commitment to customer satisfaction.